What is Property Asset Progression?

In Singapore, Property Asset Progression essentially refers to growing of one’s wealth through carefully planned investments in properties.

The end objective of Property Asset Progression is to allow the person to build up a good retirement fund for golden years through sound investment in properties.

There are different ways and methods to approach Property Asset Progression depending on the life stage you are in and your unique circumstances.

For many of us, our dream is to own at least one home in which we can spend our days happily and worry-free with our loved ones. We can enjoy our days peacefully and joyfully, whipping meals for family and bonding over food.

Privacy and Relaxation. We would love to live somewhere exclusive – even living on the ground floor of our condo means we don’t get strangers peeking into our windows and doors. Our children and pets can roam freely in the compound and enjoy what our estate has to offer, while we relax after a long day at work.

While we know living in HDB flat means we have a shared common area with the public, we certainly can achieve Privacy & Relaxation living in a condo.

Upgrading from a HDB to a Condo is a dream for many – and it is totally possible if you plan & strategise early, regardless of whether you are already living in a HDB flat, or about to buy your first property.

Every Investment Comes With Certain Risk, Through Careful Financial Planning, We Can Minimise The Risk and Achieve Our Dreams.

What Works For Others May Not Work Out For Everyone

Contact Us Now To Schedule An Appointment To Assess If You Are Suitable To Apply The Property Asset Progression Strategy

Why Property Asset Progression?

Singapore has a very high home ownership rate at 90.4% (based on data from Department of Statistics Singapore) as of December 2019.

Asset Progression is not just about progressing from property to another better property.

It directly affect how and the manner that we will RETIRE when we stop working.

How many people actually think about RETIREMENT? When we are in our 20s, we were more concerned on which night clubs to party, where to meet our friends, where to travel for our next holiday. When we begin to settle down probably in our 30s, we have to think for our spouse, our children and their education.

Have you ever sit down one day and think how much money do you need to sustain your life when you stop working completely?

To be realistic, we want to be independent from our children when we retire. Our children will eventually have their own family, their own mortgages and heavy expenses to pay every month, not to mention that all parents are so afraid that their children cannot afford to buy their own home in the future, so we do not want to be a burden or dependent on them.

In Singapore, our social welfare net is not very strong, and retirement planning is usually taken care by individual citizen. The CPF is considered our “retirement fund”, but everyone knows that CPF Ordinary Account(OA), which forms the largest amount of money for our retirement is being used to finance our property purchase, which not much is left for retirement.

We are lucky that in Singapore, our home ownership is one of the highest in the world. Our property forms a huge part of our total asset, and hence, most citizens in Singapore will need to plan properly on how to leverage on their property to facilitate their retirement in the future.

It is almost in every Singaporean’s blood to want to own a piece of real estate here in Singapore. And in many cases, some may want to own multiple properties for very good reasons if you take another few minutes to continue reading.

And do you know that almost one in five buyers of Singapore properties is a Singapore permanent resident or foreigner? Some examples of very high profile purchasers of Singapore properties in recent years: Eduardo Saverin, James Dyson, Jim Rogers, Sun Tongyu, Jackie Chan, Jet Li.

Why Do Foreign Buyers Have So Much Confident In Singapore Housing & Properties?

Many foreign buyers are attracted to invest in Singapore properties or purchase one to stay in for the following reasons:

- Political Stability

- Education System

- Low Crime Rate and Safe Environment

- One Of The Leading Financial Capitals In The World

- Great Value of Singapore Properties Compared To Other Cities In The World

Home buyers and foreign investors of Singapore properties have been able to leverage on these trends to lock in good profits from property price appreciation, en-bloc sales and earn good passive rental income from their properties.

Very often, earnings from real estate investments form a part of Singaporeans’ retirement planning. And for some, a major component.

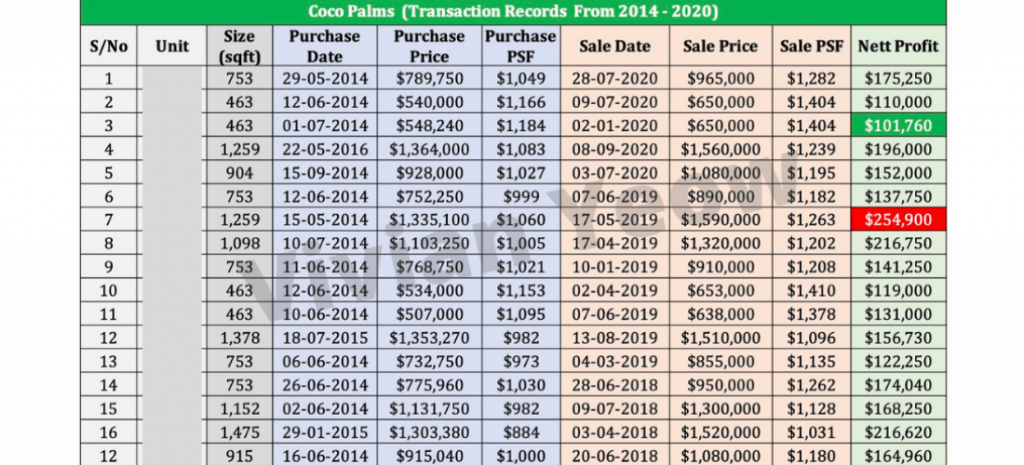

A Simple Case Study – Coco Palms

We do not have to go far to see what happen when real estate investments is done the right way.

This transaction chart below shows how much the buyers who bought into Coco Palms (new launch) in 2014 and sold in 2018-2020.

Coco Palms Past Transaction (Buy and Sell) From 2014 to 2020

The transaction data shows that the lowest realised profit is $101,760 while the highest realised profit is $254,900.

Realistically, are you able to save between $101,000 – $250,000 for a time frame of 4 – 6 years from your monthly income alone?

Best & Safest Investment Instrument

Real estate is one of the best and safest way to achieve financial freedom. This is why a lot of Singaporeans and foreigners are always interested in Singapore properties.

Not everyone understands the real estate market well and know how to leverage on it as this is not taught in school. It is never too late to learn and benefit from it.

The younger you start planning for asset progression, the more advantage you have. Why? To understand more on the Singapore MAS Rules For Housing Loan for private housing and HDB, you can find out more under “Mortgage/Bank Loan” section in my website.

Those with the benefit of guidance, get an early advantage in planning and executing the right real estate moves.